Nature-based credit markets at a crossroads

Nature-based credit markets at a crossroads

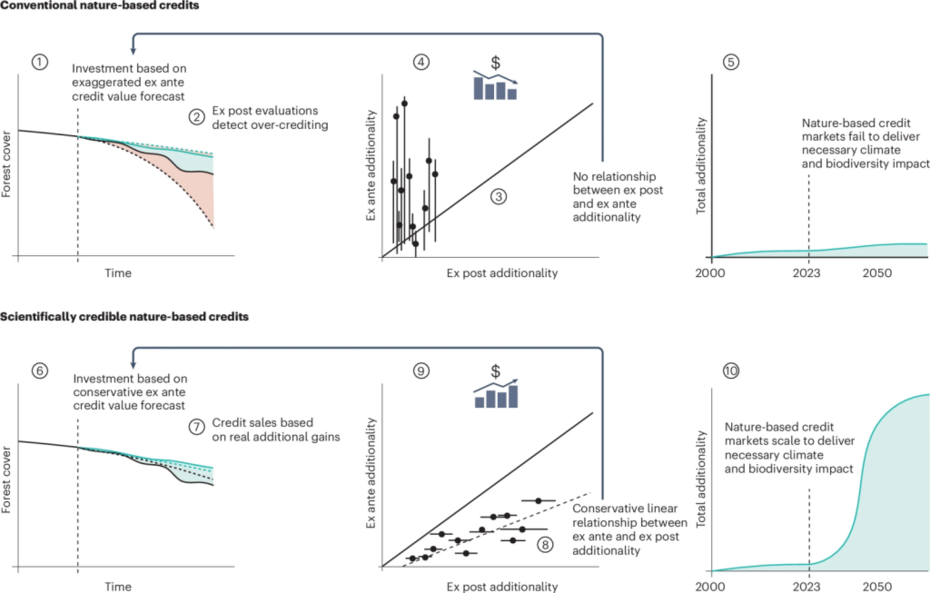

Continuing to produce nature-based credits using dubious accounting methodologies will yield limited carbon and biodiversity gains. Establishing scientific credibility unlocks the potential of credits to meaningfully contribute to targets of the Paris and Kunming-Montreal agreements.

A swathe of recent impact evaluations demonstrating disappointing results suggest nature-based credits are at a crossroads. Either nature-based credit markets continue to implement crediting processes replete with implicit incentives to over credit, lose investor confidence and constrain one of our most promising tools for drawing private investment into conservation; or fundamentally reform to adopt the latest scientific understanding on additionality, leakage and permanence, as well as environmental and social safeguards, that will rebuild investor confidence and allow them to upscale to meet the ambition of the Kunming-Montreal and Paris agreements. Here the fundamental problems embedded in conventional nature-based credits and the solutions needed to achieve scientific-credibility are laid out.

- Economic & Financial

- Planning & Upscaling

- Social & Stakeholder

- Funders & Investors