2.2 Voluntary Biodiversity Markets

A biodiversity credit represents a measured unit of positive biodiversity outcome that can be marketed (Wauchope et al., 2024). These credits can be earned through on-the-ground actions of active restoration (“biodiversity uplift”) and/or conservation of threatened biodiversity (“avoided biodiversity loss”), against a respective predefined counterfactual (Ducros and Steele, 2022; Pollination, 2023). Advocates see great potential to mobilize private conservation finance (Nature Finance, 2023; The Biodiversity Consultancy, 2022). Biodiversity credits are a way to turn positive actions for nature into something that can be measured, owned, and traded. They let credit buyers claim the benefits, make it possible to compare different efforts using a common unit (commensurability), and allow these benefits to be shared across projects (divisibility), bought and sold in a market (tradeability), or saved for future use (storability).

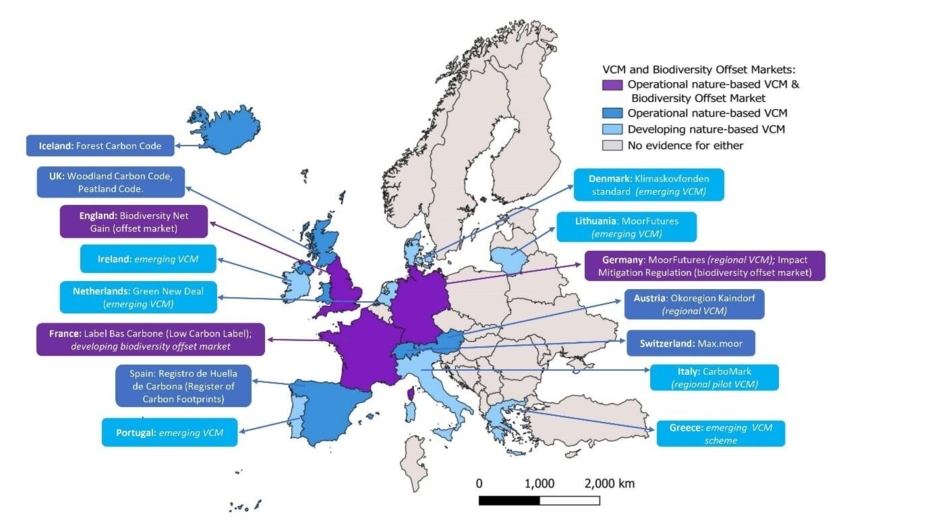

Fuelled by a strengthened international conscience about rapid yet hard-to-reverse biodiversity losses, interest in biodiversity credits has been increasing. This has been inspired by past concepts and growth in the VCM and nature-based solutions (NbS), with several of the same project proponents being active. Various business and policy initiatives (e.g., British-French International Advisory Panel on Biodiversity Credits; the World Economic Forum Biodiversity Credits Initiative; the Biodiversity Credits Alliance) are investigating credit market development, with early-stage trades already occurring.

The SUPERB biodiversity credit research as summarized by Wunder et al. (2025) reviewed the underlying theory of change, the emerging market, and the developing design features of biodiversity credits. Biodiversity credits face many similar challenges to their carbon cousins, struggling between financial viability and effective implementation – though commensurability and tradability for multidimensional biodiversity is a much tougher challenge than for carbon, with an unambivalent global GHG currency (CO2 equivalents).

With regard to the most recent implementation status (as of September 2023), 41% of the scrutinized schemes were already operational (9% as pilots), but most at pilot scales; the rest was still under development. Most experiences focus on biodiversity in either terrestrial (56%) or marine ecosystems (15%); 23% covered multiple ecosystems. Credits were quite equitably distributed in their focus on averted loss and/or biodiversity maintenance actions (23%), as compared to biodiversity improvements/’uplifts’ (18%), while most schemes in fact combine both objectives. Project horizons generating those credits were mainly in the range of 10-20+ years.

Related resources

The current state, opportunities and challenges for upscaling private investment in biodiversity in Europe

Opportunities arise from macroeconomic and regulatory changes, along with various technological and financial innovations and growing professional experience. However, persistent barriers to upscaling include the ongoing lack of highly profitable investment opportunities and the multitude of risks facing investors.

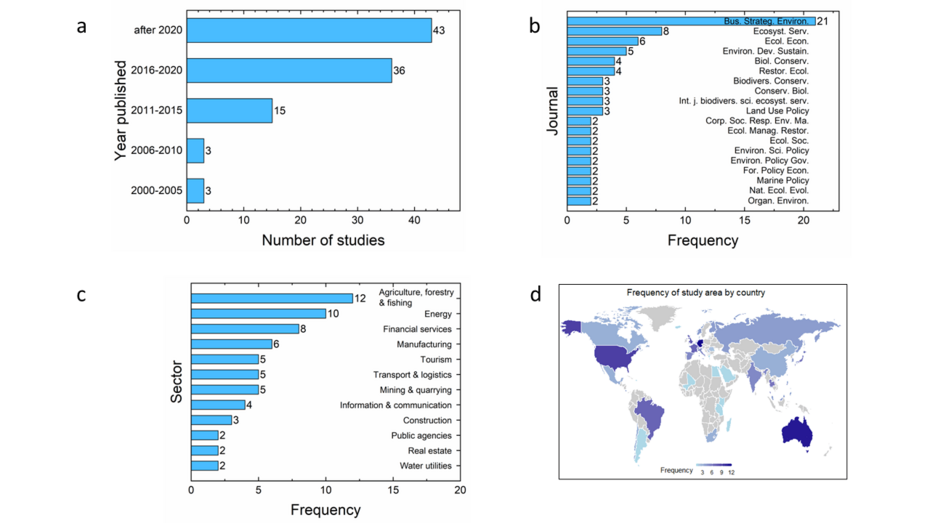

A Scoping Review of Determinants of Business Engagement with Biodiversity

Companies are driven by multifaceted factors, with economic motivations including operational management and profitability frequently recorded. Regulatory frameworks motivate corporate engagement through legislation compliance while posing challenges due to regulatory uncertainty and inconsistent policies.

Biodiversity credits: learning lessons from other approaches to incentivize conservation

Biodiversity credits are emerging for pro-environmental finance. We explore their impact, supply/demand, bundling, and safeguards, reviewing 34 pilots and lessons from offsets and carbon credits. Challenges include additionality, permanence, leakage, and making biodiversity marketable. Robust baselines, standards, and governance are needed to ensure quality and avoid past mistakes.

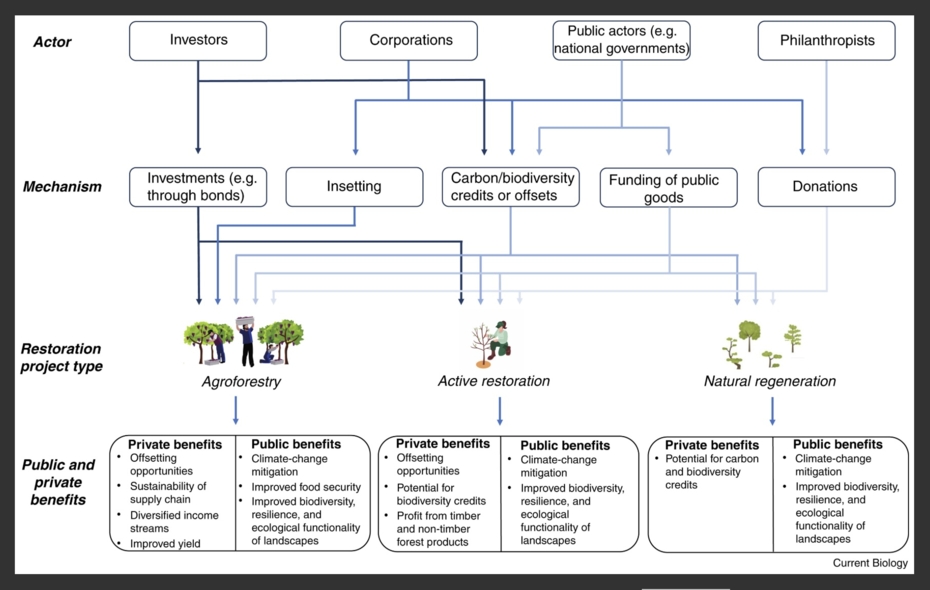

Financing ecosystem restoration

Global ecosystem restoration targets face slow progress, hindered by funding gaps. While public funds dominate, scaling private finance is crucial but limited by lack of profitable investments. Market mechanisms like voluntary carbon and biodiversity offset markets attract private funds but risk misalignment with social and ecological goals. Strong governance and oversight are essential to ensure positive outcomes.