2.1 Voluntary Carbon Markets

To finance these added costs in forest restoration, including under the pressure to adapt to climate change, public finance will doubtlessly be key. Examples are the European Agricultural Fund for Rural Development, currently banking ~90% of EU forestry funding, or more recently the European Investment Bank with its Natural Capital Financing Facility supporting also rewilding processes and creating economic incentives for conserving natural landscapes. The EU Carbon Removals and Carbon Farming Certification Regulation, implemented from December 2024, is another new but important framework (Chiti et al., 2024).

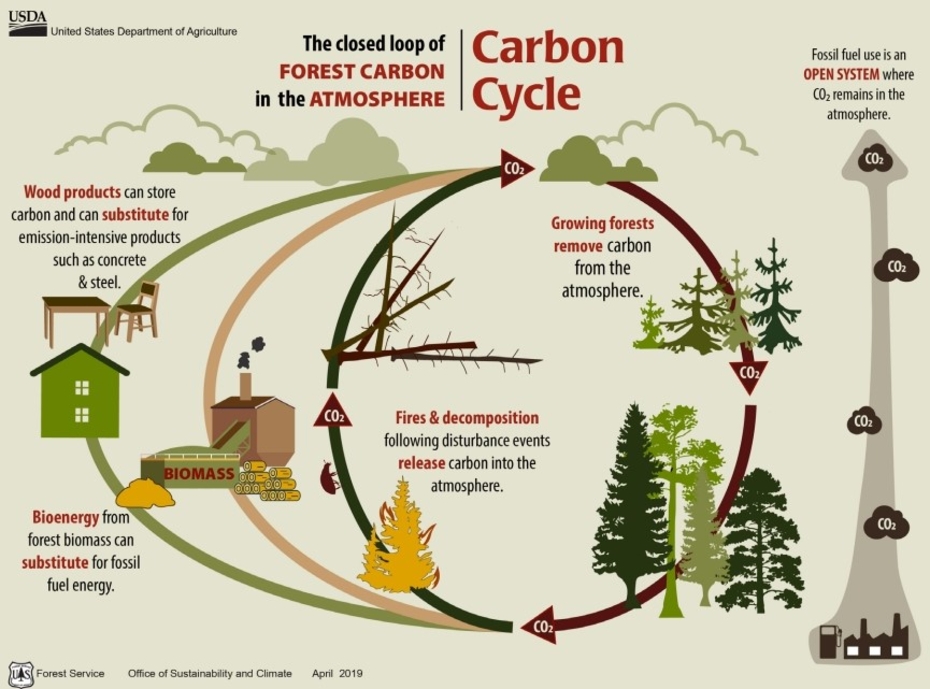

What about private sources of carbon finance, then? Voluntary carbon markets (VCM) can indeed help mobilize private financing to incentivize landowners for adopting practices that enhance carbon sequestration. Companies, organizations or individuals voluntarily purchase carbon offsets to compensate for their emissions, while forest owners appreciate potential sources of added forest income. Carbon credits represent offsetting reductions or removals of greenhouse gases (GHG) elsewhere, which are quantified and then sold to those aiming to "neutralize" their own emissions. Unlike compliance markets for carbon, such as the EU’s huge Emissions Trading System (where forests nonetheless are not eligible), VCM participation is not required by law. It is typically pursued to meet corporate social responsibility goals, demonstrate environmental stewardship, or appeal to environmentally conscious consumers.

In practice, however, the role of European forest restoration in the VCM has remained quite restricted. In 2022, credits from European projects in nature-based solutions made up less than 1% of total VCM trade volumes (Environmental Finance, 2024). The VCM has instead been dominated by operations implemented in the Global South, mainly from renewable energy, avoided deforestation and improved cookstoves projects (Mikolajczyk and Diaz, 2025). In forestry in particular, Global-South projects tend to have comparative advantages of faster biomass growth and lower land and labour costs than in the Global North, while conversely facing higher governance constraints that may increase risks (Larjavaara, 2018). Overall, VCM trade volumes grew rapidly to reach a peak in 2021 (362 Mt), but then gradually declined to 287 Mt in 2024 (Mikolajczyk and Diaz, 2025). By the end of 2024, the ten carbon registries tracked by the VCM Dashboard had issued a total of 2.16 billion carbon credits. However, the stockpile of non-retired credits has also gradually grown to 0.98 GtBy the end of 2024. (Mikolajczyk and Diaz, 2025).

As a European forest owner looking to undertake commercial carbon farming and sell carbon credits correspondingly, where would one tentatively turn to? In spite of the VCM’s difficulties, several marketplaces are nonetheless emerging, such as for instance the OCELL Platform (focused on Northern Europe and Baltics) or Ecobase, a European forest carbon footprint developer (with afforestation, reforestation, and revegetation (ARR) projects). In addition, new market options could include the suggested creation of temporary forest carbon credits operating at discounted prices (Chiti et al., 2024). A challenge has been to bridge between large-scale credit demand and mostly small-scale efforts happening on the forest supply side.

Notably, competing Global-South based voluntary carbon credits have suffered recent backlashes, based on high-level scientific assessments calling severely into question their environmental integrity – this concerns both avoided-deforestation projects (e.g. West et al., 2023) and credits from improved cookstoves (Gill-Wiehl et al., 2024). This could harm the overall reputation of the voluntary carbon market and offsetting. But it could also create an advantage for European ARR projects, which are better able to prove their high level of additionality (see Chapter 04.2). In carbon markets, additionality means that a carbon project results in emissions reductions or removals that would not have happened without the project. Carbon credit prices from European ARR projects are thus also trading at significantly higher prices: in 2023, European credits traded on average of €25, whereas the global average was around €7 (Forest Trends Ecosystem Marketplace, 2023). Further insight on VCM with a focus on nature-based removals via ARR projects is provided by Landlife in Chapter 4.1.

Related resources

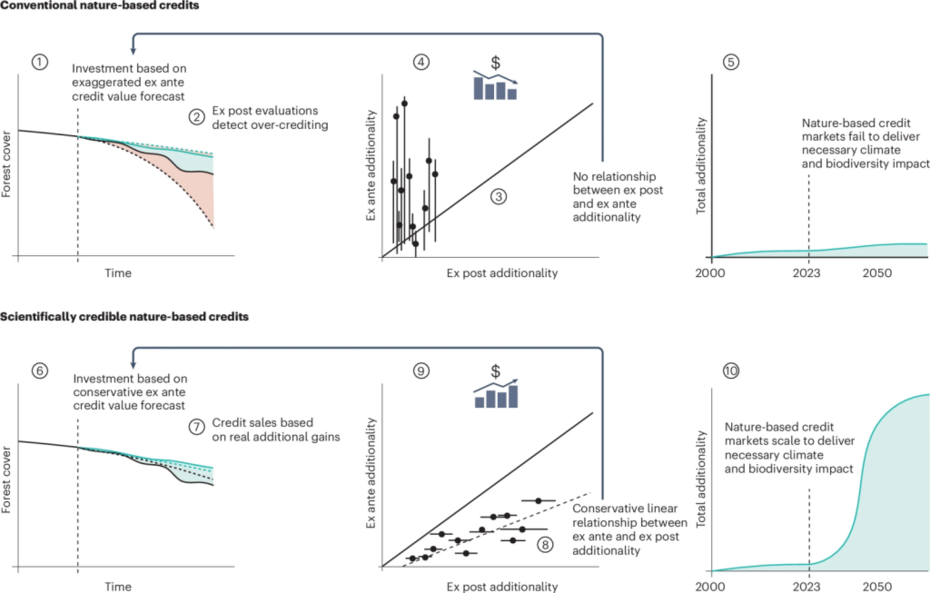

Nature-based credit markets at a crossroads

Continuing to produce nature-based credits using dubious accounting methodologies will yield limited carbon and biodiversity gains. Establishing scientific credibility unlocks the potential of credits to meaningfully contribute to targets of the Paris and Kunming-Montreal agreements.

Carbon farming in the European forestry sector

This EU policy report explores how forest management can boost carbon sequestration. It analyses the potential of forest management practices as carbon farming measures and points out the challenges for monitoring and implementing mitigation milestones in carbon farming practices. The report also explores the policy and economic framework and recommends key criteria for the successful implementation of carbon farming instruments.