Planners / Implementers

2.5 Finance

Restoring forests at scale requires more than ecological knowledge - it also depends on innovative and reliable financial support. Across Europe, a variety of financial mechanisms are in place or under development, combining public policies, private investments, and hybrid approaches. These include payments for ecosystem services (PES), carbon markets, subsidies, and philanthropic funds. Identifying the right mix of tools is essential to ensure that restoration efforts are economically viable, socially accepted, and ecologically meaningful. This section offers an entry point to understand how different financial models can support long-term forest restoration across diverse contexts.

In the further reading materials (mentioned below under “related resources”), we introduce examples such as PES, carbon schemes (Label Bas Carbone), subsidies, forest certification, and private endowment funds like Plantons pour l’avenir. Insights from 398 responses to the SUPERB online questionnaire inform an open-access database of practical restoration knowledge. Region-specific approaches, such as North Rhine-Westphalia’s silvicultural and reforestation concepts, demonstrate how financing can align with local ecological needs. Other topics include green infrastructure, small forest patch restoration, and adaptive management.

Related resources

Restoration Project Developers’ Playbook on Private Finance (Europe)

For restoration project developers to gain access to funding, they must first understand the various sources of finance available and how to access them. The Restoration Project Developers’ Playbook on Private Finance (Europe) aims to help restoration project developers understand existing private finance options and assess whether these can be suitable to meet their needs.

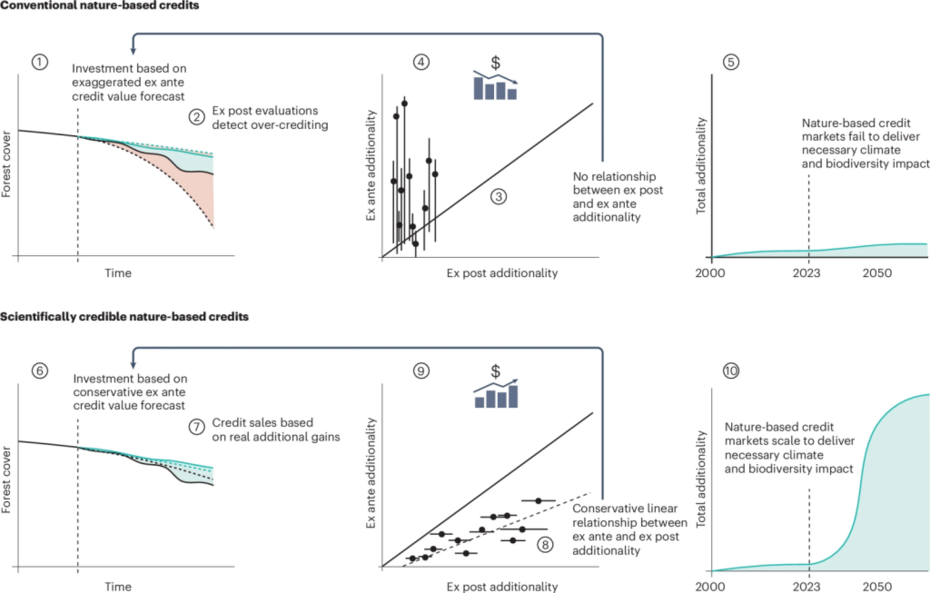

Nature-based credit markets at a crossroads

Continuing to produce nature-based credits using dubious accounting methodologies will yield limited carbon and biodiversity gains. Establishing scientific credibility unlocks the potential of credits to meaningfully contribute to targets of the Paris and Kunming-Montreal agreements.

Biodiversity credits: learning lessons from other approaches to incentivize conservation

Biodiversity credits are emerging for pro-environmental finance. We explore their impact, supply/demand, bundling, and safeguards, reviewing 34 pilots and lessons from offsets and carbon credits. Challenges include additionality, permanence, leakage, and making biodiversity marketable. Robust baselines, standards, and governance are needed to ensure quality and avoid past mistakes.

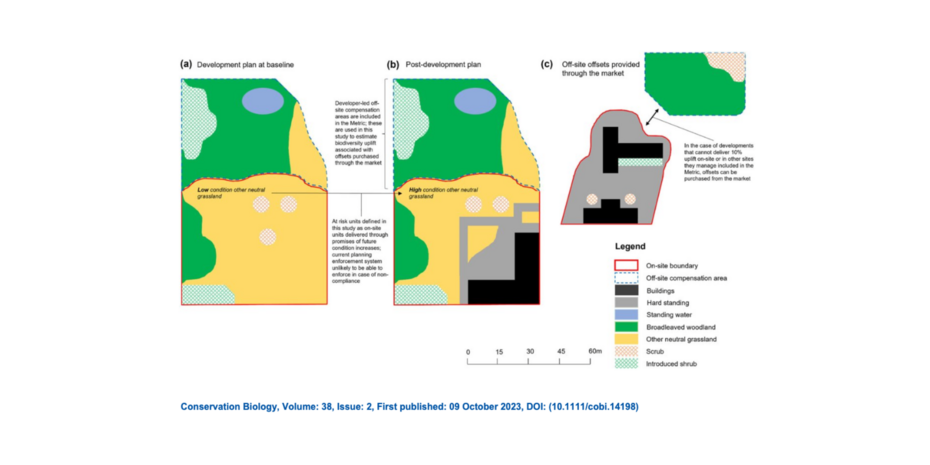

Achieving biodiversity net gain by addressing governance gaps underpinning ecological compensation policies

This study evaluates England’s new biodiversity net gain (BNG) policy. Analyzing major developments from 2020–2022, it finds 27% of biodiversity units at high risk of noncompliance due to governance gaps. Errors in BNG calculations were common, and under-resourced councils often approved flawed plans. Stronger governance and monitoring are needed to ensure policy effectiveness.

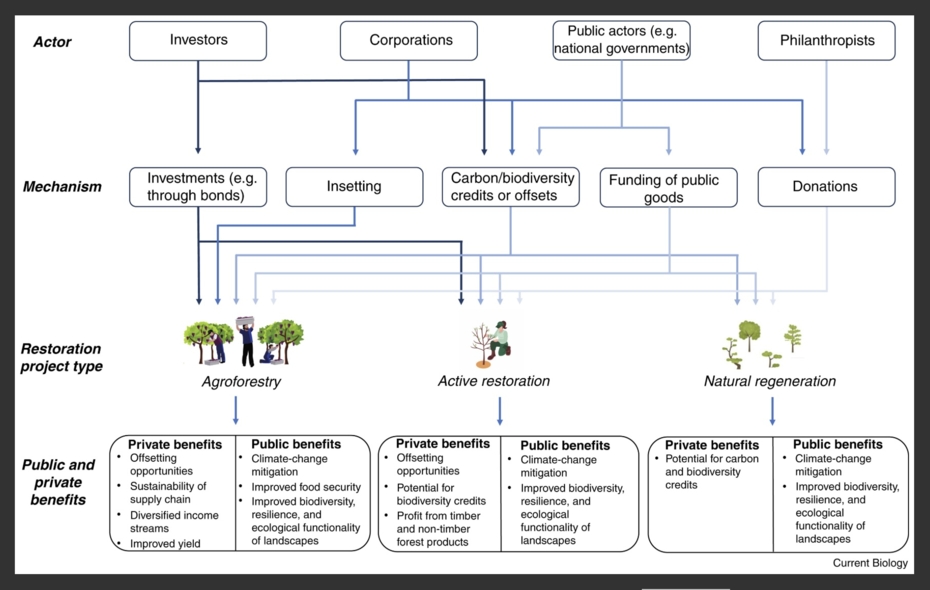

Financing ecosystem restoration

Global ecosystem restoration targets face slow progress, hindered by funding gaps. While public funds dominate, scaling private finance is crucial but limited by lack of profitable investments. Market mechanisms like voluntary carbon and biodiversity offset markets attract private funds but risk misalignment with social and ecological goals. Strong governance and oversight are essential to ensure positive outcomes.