Policy Actors

4.1 The role of policy in financing restoration

Key finding 1: Private investment in nature is very unlikely to scale up sufficiently to meet overall funding goals without clear drivers of demand

Nature markets have been implemented across the world in various forms for over 30 years. We have plenty of experience of what has worked and what has failed in nature markets across the world. By far the world's largest nature market is the wetland mitigation banking system in the United States, which aims to achieve the regulatory objective of no net loss of wetlands resulting from development that impacts on wetlands. This market generates several billion dollars worth of investments in nature restoration annually (UNEP 2023). The history of the US wetland mitigation system demonstrates that one of the consistent lessons from nature markets around the world is that the main predictor of nature markets that have successfully scaled, i.e. driven substantial private investment in nature conservation and restoration, are those for which there is a regulated mandatory driver of demand. The only exception to this is the international voluntary carbon market, which at its peak generated over a billion dollars of investment in carbon credits per year. However, major integrity scandals that hit the system in 2023 have led to a collapse in trust and investment in this market since. Our interviews with investors have demonstrated that these integrity scandals in the international voluntary markets have greatly increased the risks and uncertainty facing investors in all voluntary nature markets. Products that were previously considered assets (i.e. helped companies make the case that they were on the pathway to achieving net-zero outcomes and therefore were responsibly managed are now considered risks. This is the case because many of the purchases of international voluntary carbon credits ended up experiencing serious reputational damage from purchasing these products. The scandals have seriously weakened confidence in investing in voluntary carbon credits, which is why having a legal or regulatory reason to create demand for them is now so important. One key way to do this is by targeting industries that harm nature and introducing rules that require them to offset the damage they cause. These kinds of mandatory biodiversity offsetting markets are applied around the world, and they already generate over $10 billion if investment in nature restoration per year (UNEP 2023).

Key finding 2: For compliance markets, the main form of uncertainty is policy risk. Policy stability and long-term commitments to markets are the key to resolving this

One of the key uncertainties and risks facing private investors is a lack of policy coherence and policy stability. When your revenues depend on an existing policy, as is the case with mandatory nature markets (where the fundamental driver of demand for nature units or credits comes from some form of legislation that makes a polluter pay for their impacts on nature), then it is absolutely critical that investors have confidence that the policy will remain implemented over time horizons that are sufficient for them to deliver attractive investment returns. However, nature markets are often dogged by policy uncertainty. This is largely the case because nature markets are introduced as additions or changes to planning policies. Whenever governments are faced with the political imperative of changing planning policies in order to enable more infrastructure expansion or the development of other economic sectors, this can directly conflict with these nature markets, which are sometimes framed as barriers to growth or infrastructure expansion. This makes these nature markets fairly uncertain and unstable. For example, in 2022 the English government introduced plans for a nature market that enabled trading of nutrient credits, but then attempted to repeal this market a couple of years later. This attempt did not succeed fully, but it did send a ripple of uncertainty throughout nature market investors and participants, which does not help build confidence that these markets will remain implemented in the long run and remain insulated from political intervention or uncertainty. In order for nature markets to scale there is a very clear need for strong long term policy signals that demonstrate to investors and other market participants that, if they build business models around the creation of revenues through the sale of commodities into nature markets, those revenues are relatively safe.

Key finding 3: Lack of policy coherence

Work in the EU has demonstrated that when nature conservation projects look for funding, there is often a multitude of potential funding sources available. This might include mixtures of public and private financing opportunities. However, in the nature conservation sector there is generally a tradition of attempting to attract grant funding and non-repayable forms of funding, and conservation practitioners in general are less experienced with return seeking forms of finance. This has real consequences, as there are cases where projects that were a good fit for private investment and passed all the necessary checks ended up receiving grant funding instead, rather than actually securing private finance (European Investment Bank 2023). In order to maximise the potential for private investment to deliver on higher level nature conservation goals, it is essential that policy makers have a strong understanding of the different characteristics of projects and what this means for which types of funding they might be able to attract in order to deliver their objectives. There is a need for coordination so that public finance and grants and non-repayable forms of funding do not undermine opportunities for private investment.

Key finding 4: Most nature credit schemes fail to achieve the various standards required for their claims to be considered scientifically credible

Our work brought together academics who have led academic evaluations of nearly all of the world's largest nature markets . We developed a series of golden rules for scientifically credible nature markets underpinned by all this evidence, and we have assessed the performance of all of the world's major nature markets according to these golden rules. The results of our evaluation demonstrate that all of the world's major nature markets still suffer from serious integrity risks. These integrity risks relate to the way that they measure their impacts on nature, and the governance of how they are designed. Many of these natural markets do not provide transparently publicly accessible information, which means that it is impossible to tell whether or not they are delivering the ecological outcomes that they are supposed to.

Related resources

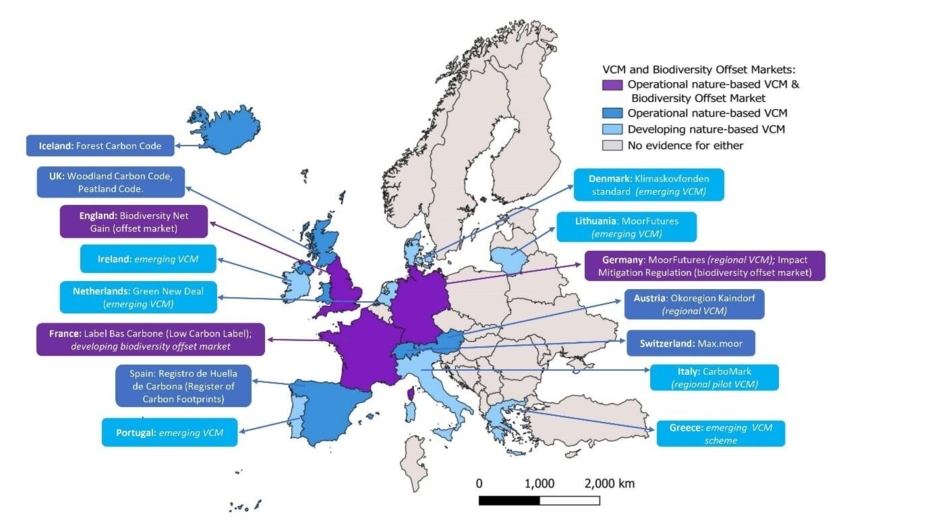

The current state, opportunities and challenges for upscaling private investment in biodiversity in Europe

Opportunities arise from macroeconomic and regulatory changes, along with various technological and financial innovations and growing professional experience. However, persistent barriers to upscaling include the ongoing lack of highly profitable investment opportunities and the multitude of risks facing investors.

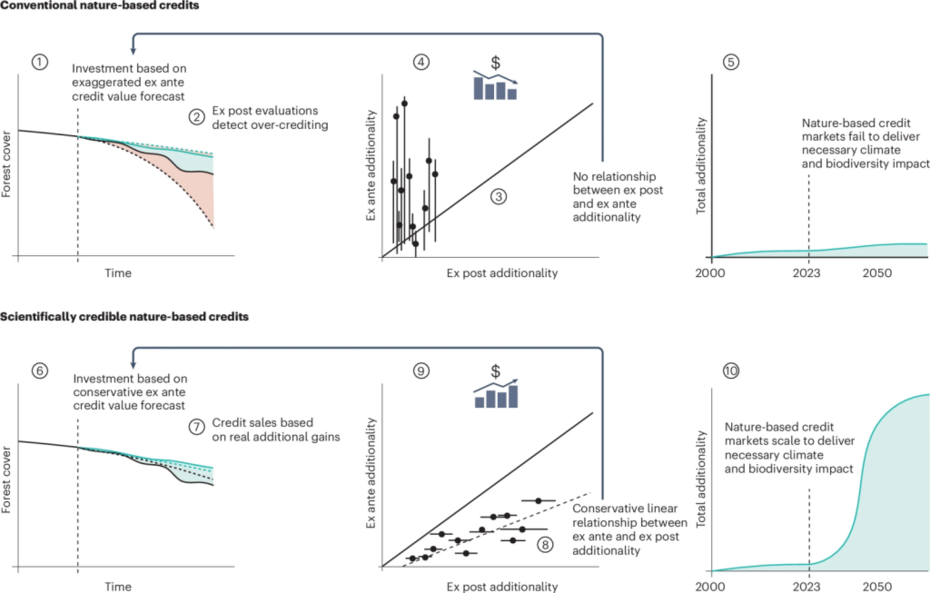

Nature-based credit markets at a crossroads

Continuing to produce nature-based credits using dubious accounting methodologies will yield limited carbon and biodiversity gains. Establishing scientific credibility unlocks the potential of credits to meaningfully contribute to targets of the Paris and Kunming-Montreal agreements.