Policy Actors

4.2 New markets for forest goods and services

Biodiversity is typically conceptualised as a public good. Subject to market failures because its value for society is not captured in conventional markets and is therefore not effectively internalised into the prices of goods and services. However, biodiversity underpins the ecosystem services upon which the economy depends, and therefore the loss of biodiversity represents a risk to economic activity. This is part of the effort to show businesses and investors that the loss of nature is a serious risk to their operations or profits – and that it makes sense to invest in protecting and restoring it. Historically dominant motivations for private investment in nature have been investing to address risks (including supply chain risks, regulatory risks and reputational risks), for corporate social responsibility, marketing purposes, or investing in carbon offsets for organisational net zero strategies. However, incentives facing organisations and investors are changing as a result of a rapidly evolving regulatory landscape and emerging voluntary initiatives on global, European and national scales.

A precondition for attracting return-seeking private investment into nature conservation is that the conservation or land management activities delivered through that investment must generate cashflows or prevent costs. Financing instruments and strategies for investing in biodiversity-related outcomes are proliferating rapidly. These include the growing number of nature-related funds, which are predominantly focused on the generation of market goods in theory associated with biodiversity co-benefits (i.e. agriculture or forestry), green bonds, and emerging mechanisms such as biodiversity credits37. However, ensuring that these private investment strategies are in reality delivering improvements in biodiversity remains extremely challenging. For example, funds invested in sustainability-certified agriculture or forestry, commonly rely on certification for their biodiversity impacts, despite limited evidence for effectiveness. For green bonds, work analysing how these actually generate revenues has found that often the link between their activities and real-world biodiversity outcomes is tenuous.

In contrast with nature-focused investments, which aim to deliver biodiversity co-benefits most commonly as a bi-product of producing market goods, the last few decades have witnessed a rapid proliferation of instruments for commodifying direct increases in biodiversity or carbon (or both) in order to create potential revenue streams from delivering improvements in nature. These include the expansion of biodiversity and carbon offsetting market-like mechanisms, perceived as the simplest classes of financial instruments for conservation to upscale and are therefore core to many countries’ ambitions for conservation funding. Whilst the ecological benefits of these market mechanisms are generally variable, no counterfactual-based evaluations to date have been conducted in Europe. A suite of countries in Europe now has domestic carbon or biodiversity markets underpinned by the state, with several others encouraging voluntary purchase of biodiversity offsets which is often a precursor to these becoming embedded in legislation (See Figure below).

Related resources

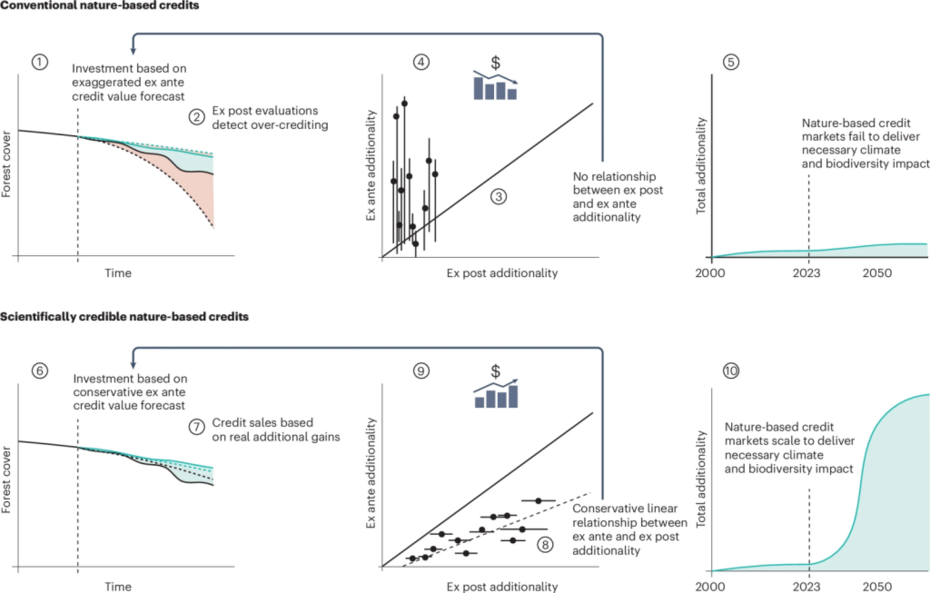

Nature-based credit markets at a crossroads

Continuing to produce nature-based credits using dubious accounting methodologies will yield limited carbon and biodiversity gains. Establishing scientific credibility unlocks the potential of credits to meaningfully contribute to targets of the Paris and Kunming-Montreal agreements.

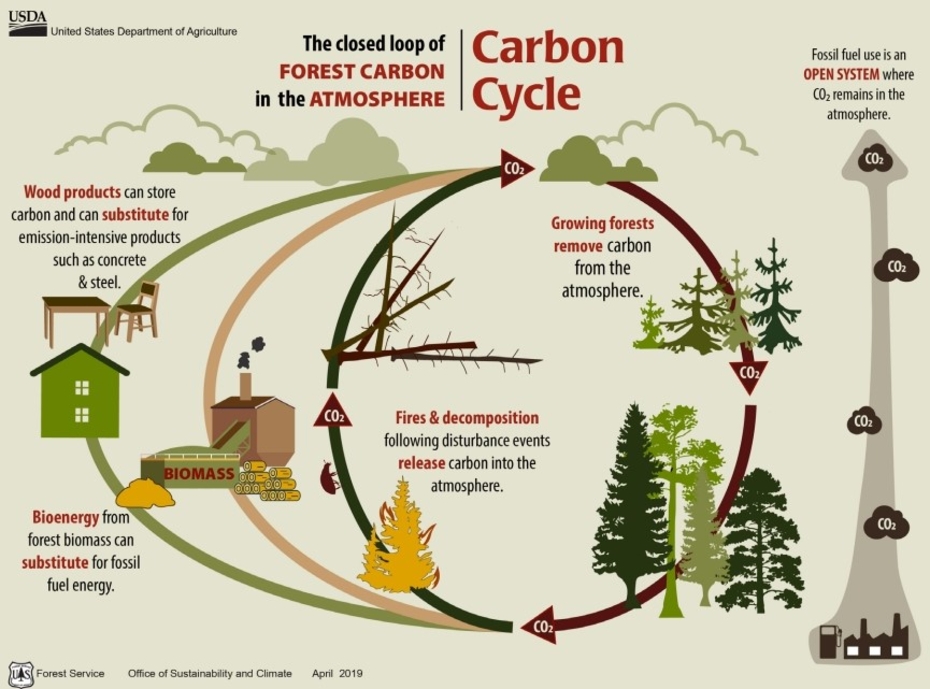

Carbon farming in the European forestry sector

This EU policy report explores how forest management can boost carbon sequestration. It analyses the potential of forest management practices as carbon farming measures and points out the challenges for monitoring and implementing mitigation milestones in carbon farming practices. The report also explores the policy and economic framework and recommends key criteria for the successful implementation of carbon farming instruments.