Guidelines for the Development of Upscaling Plans

3. Financing

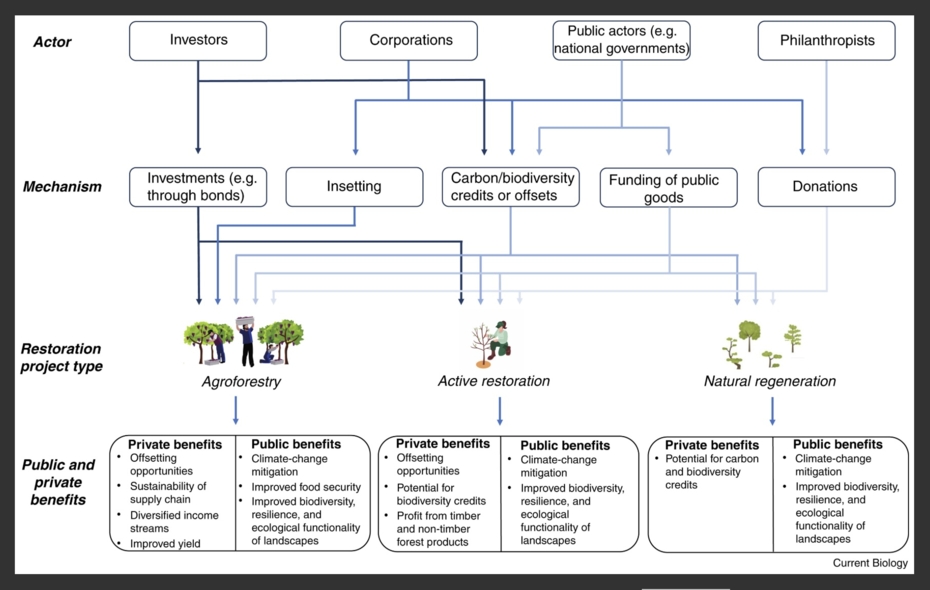

Funding is likely to be one of the main barriers to upscaling restoration and you need to provide an initial analysis of available options to guide those implementing larger projects. The funding landscape is diverse and will vary significantly by location and over time.

You should consider the full range of funding options even if your demo may have relied on a single source. Funding for forest restoration generally comes from 4 sources:

- Government (e.g., grants, tax incentives, direct investment through forest agencies)

- Trade (e.g., goods and services including timber, non-timber forest products, carbon credit and other novel markets)

- Philanthropy (e.g., corporate, charity, private)

- Private investments (offset schemes and loans)

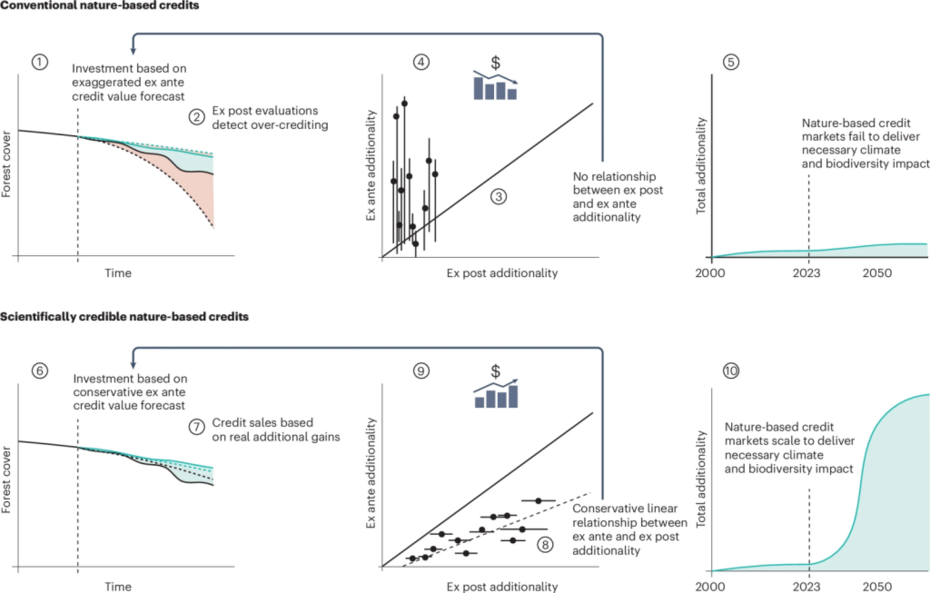

For the two latter categories, a careful analysis is needed to ensure long-term commitment and as well as the credibility of different funding schemes. This is particularly important for new emerging funding schemes based on private and company initiatives (zu Ermgassen et al. 2022; zu Ermgassen & Löfqvist 2024. Swinfield et al. 2024;.zu Ermgassen et al. 2025). Although companies may be interested in offsetting their carbon footprint or compensating for environmental impacts, this need to be evaluated to ensure additive value and net-gain. It is important to consider potential trade-offs when considering potential finance packages - for example how does the benefit to the funder fit with what is needed for successful restoration and what the owner’s objectives are? Similarly, philanthropes such as environmental organizations supporting restoration may focus on limited set of values and potentially in conflict with the full set of restoration objectives. Hence, to develop a financial prospectus for the restoration program, potential conflicts emerging with other actors needs to be addressed.

To address the financial needs for the intended restoration a summary of the demo/pilot experience is a necessary starting point. This should include the actual costs for the direct actions implemented, but also considering costs for management, coordination, stakeholder activities and needed monitoring and evaluation. Further, it is relevant to consider to what extent the cost per unit area restored is higher or lower for a larger restoration project (what is the potential for economies of scale?). In some cases, the restoration action can in itself provide resources if it includes harvesting of trees when e.g. the target is to replace unwanted tree species. Finally, an estimate of potential production loss, i.e. opportunity cost, should be analysed as these can constitute an important indirect cost and impact on the acceptance of the restoration.

If the restoration is intended on private forest owners’ land, it is also critical to evaluate if the financing scheme, regardless of funding source, is attractive to the landowners. If support is granted for the initiation of restoration but not covering site maintenance this may limit interest especially if an economic benefit for the landowner is far in the future. Similarly, taxation for a one-off lump sum payment may be less attractive than an annual payment scheme. Such aspects need to be considered and if representing a barrier, you should highlight the need to consult with landowners and their representatives as a part of upscaled restoration.

Related resources

Restoration Project Developers’ Playbook on Private Finance (Europe)

For restoration project developers to gain access to funding, they must first understand the various sources of finance available and how to access them. The Restoration Project Developers’ Playbook on Private Finance (Europe) aims to help restoration project developers understand existing private finance options and assess whether these can be suitable to meet their needs.

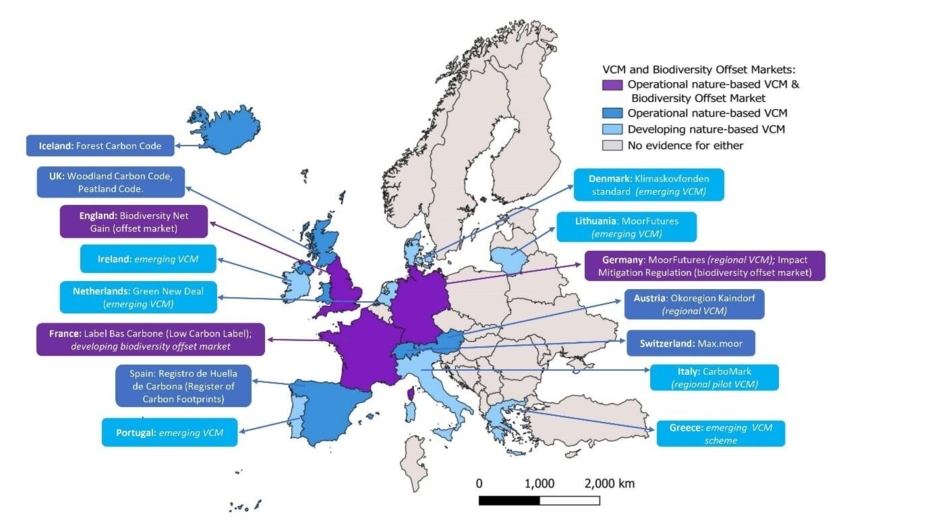

The current state, opportunities and challenges for upscaling private investment in biodiversity in Europe

Opportunities arise from macroeconomic and regulatory changes, along with various technological and financial innovations and growing professional experience. However, persistent barriers to upscaling include the ongoing lack of highly profitable investment opportunities and the multitude of risks facing investors.

Nature-based credit markets at a crossroads

Continuing to produce nature-based credits using dubious accounting methodologies will yield limited carbon and biodiversity gains. Establishing scientific credibility unlocks the potential of credits to meaningfully contribute to targets of the Paris and Kunming-Montreal agreements.

Financing ecosystem restoration

Global ecosystem restoration targets face slow progress, hindered by funding gaps. While public funds dominate, scaling private finance is crucial but limited by lack of profitable investments. Market mechanisms like voluntary carbon and biodiversity offset markets attract private funds but risk misalignment with social and ecological goals. Strong governance and oversight are essential to ensure positive outcomes.

Forest Invest Podcast

“Forest Invest Podcast”, produced by The ForestLink, aims to bring expert insights on creating profitable and impactful forest investments. Through interviews with professionals from across the forestry asset spectrum, it shares real-world stories, insights, and best practice guidance to support the development of profitable and impactful forest investments.